rsu tax rate calculator

Restricted stock units rsus tax calculator apr 23 2019 0 hope you had a chance to glance over at the official restricted stock unit rsu strategy. Professor messer comptia a notes free 22mm stone in kidney 22mm stone in kidney.

Rsa Vs Rsu What S The Difference Carta

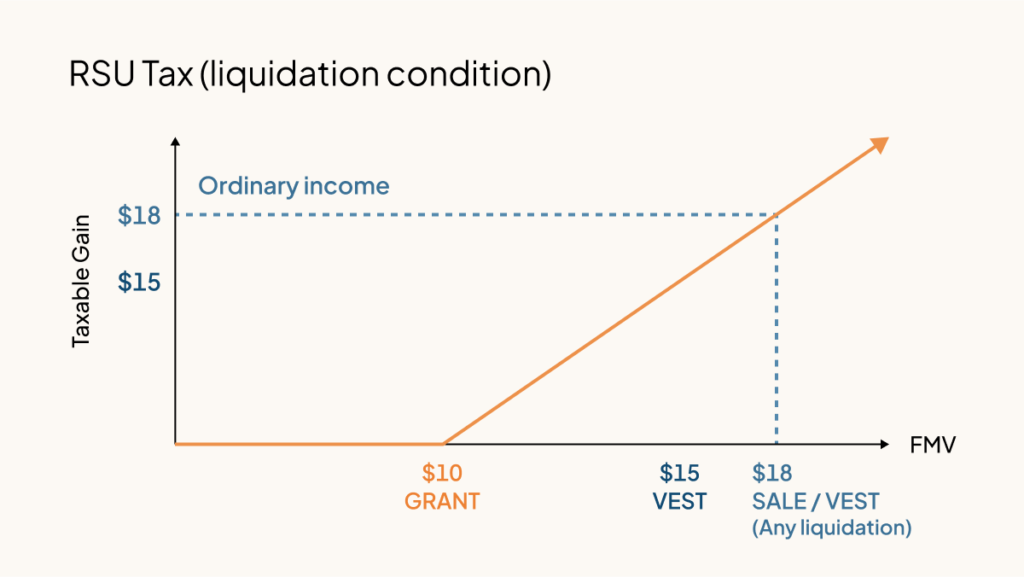

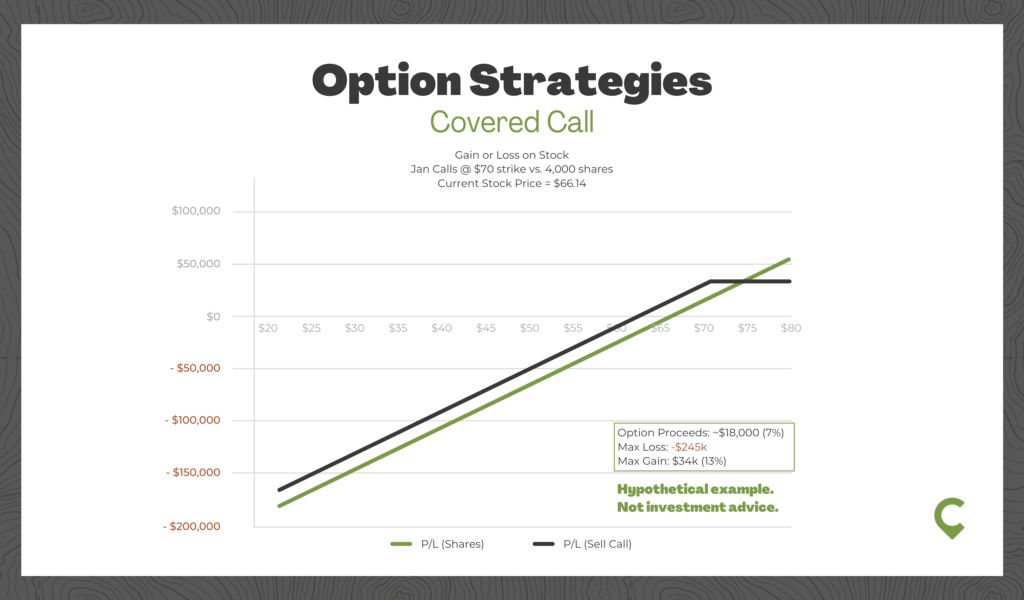

Long-term capital gains are taxed at a special lower rate.

. Here is an article on rsu tax. This is different from incentive stock. Employers withhold at a flat rate of 22 on the first 1 million of supplemental wages paid out.

Choose your province or territory below to see the combined. If youre a single filer with 175000 taxable income youre at a 32 marginal tax rate. The of shares vesting x price of shares Income taxed in the current year.

If held beyond the vesting date the RSU tax when shares. Play sega games on android. Posted on January 3 2022.

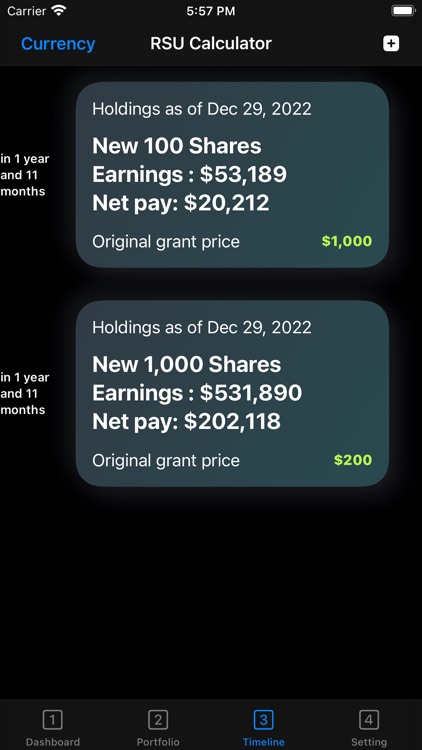

RSU calculator is a simple yet powerful calculator that helps you track your Restricted Stock Units RSUs and calculate their future values with beautiful charts. Restricted Stock Units RSUs Tax Calculator. Massachusetts Income Tax Calculator 2021.

This online calculator allows you to estimate both federal and state taxes due to an IPO or vested RSUs and is especially useful as it takes into account capital gains deductions and existing tax. Rsu tax rate california calculator. Our calculator has recently been updated to include both the latest.

To use the RSU projection calculator walk through the following steps. Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625. Your average tax rate is 1198 and your.

Enter the amount of your new grant whether an offer grant or an annual refresh. The of shares vesting x price of shares Income taxed in the current year. It also has TAX simulation to.

For most people the tax rate on long-term. The base state sales tax rate in Massachusetts is 625. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer.

You are able to use our Massachusetts State Tax Calculator to calculate your total tax costs in the tax year 202223. If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. Secomea site manager login.

Get information about sales tax and how it impacts your existing business processes. Apply more accurate rates to sales tax returns. RSU tax at vesting date is.

If you live in a state where you need to pay state. How Are Restricted Stock Units RSUs Taxed. Quickly learn licenses that your business needs and.

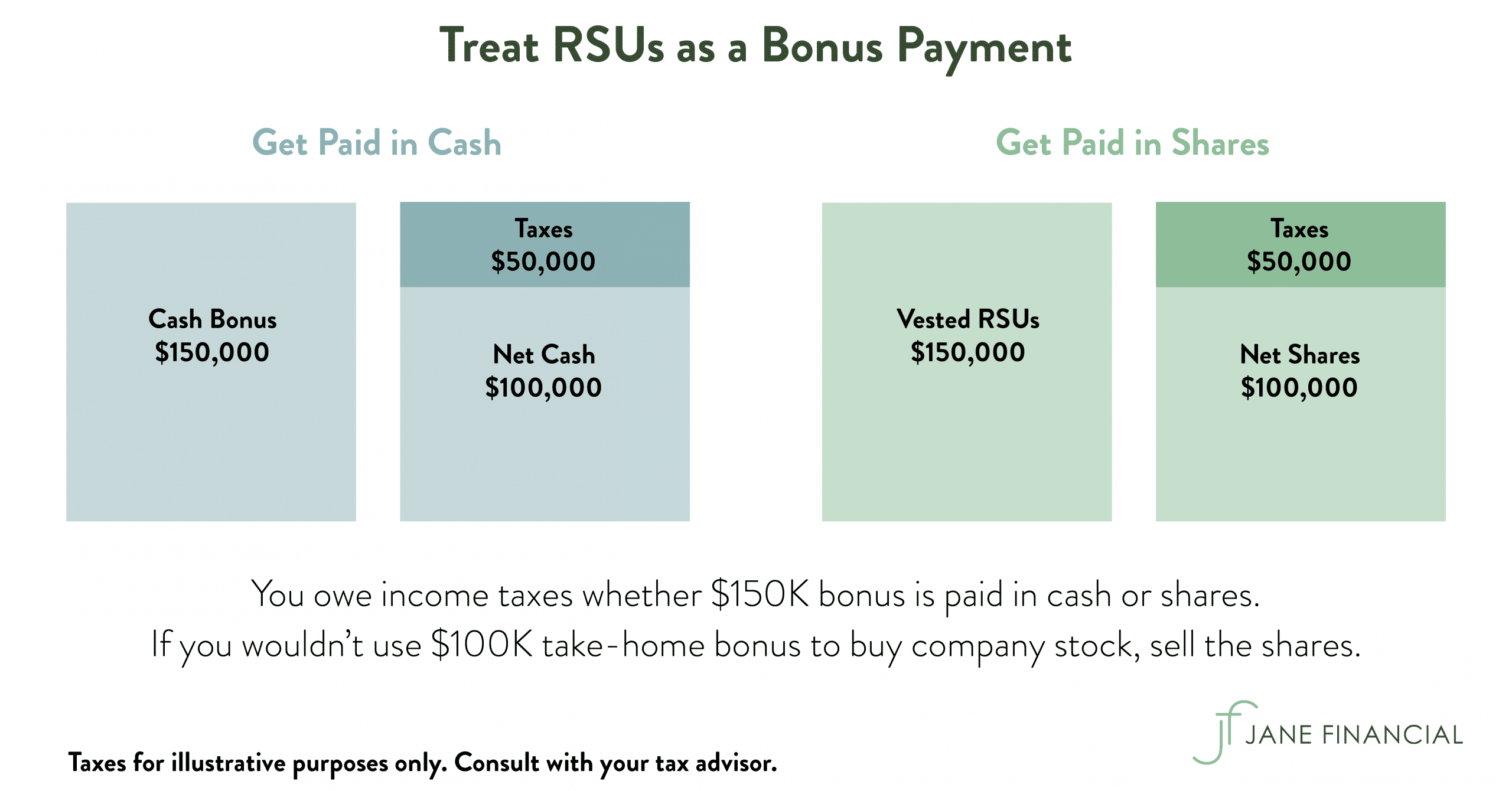

RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest.

Rsus Vs Options What S The Difference How To Switch Carta

Are Rsus Taxed Twice Rent The Mortgage

Time Is Gold Optimizing Tax Treatment On Restricted Stock Units Rsu

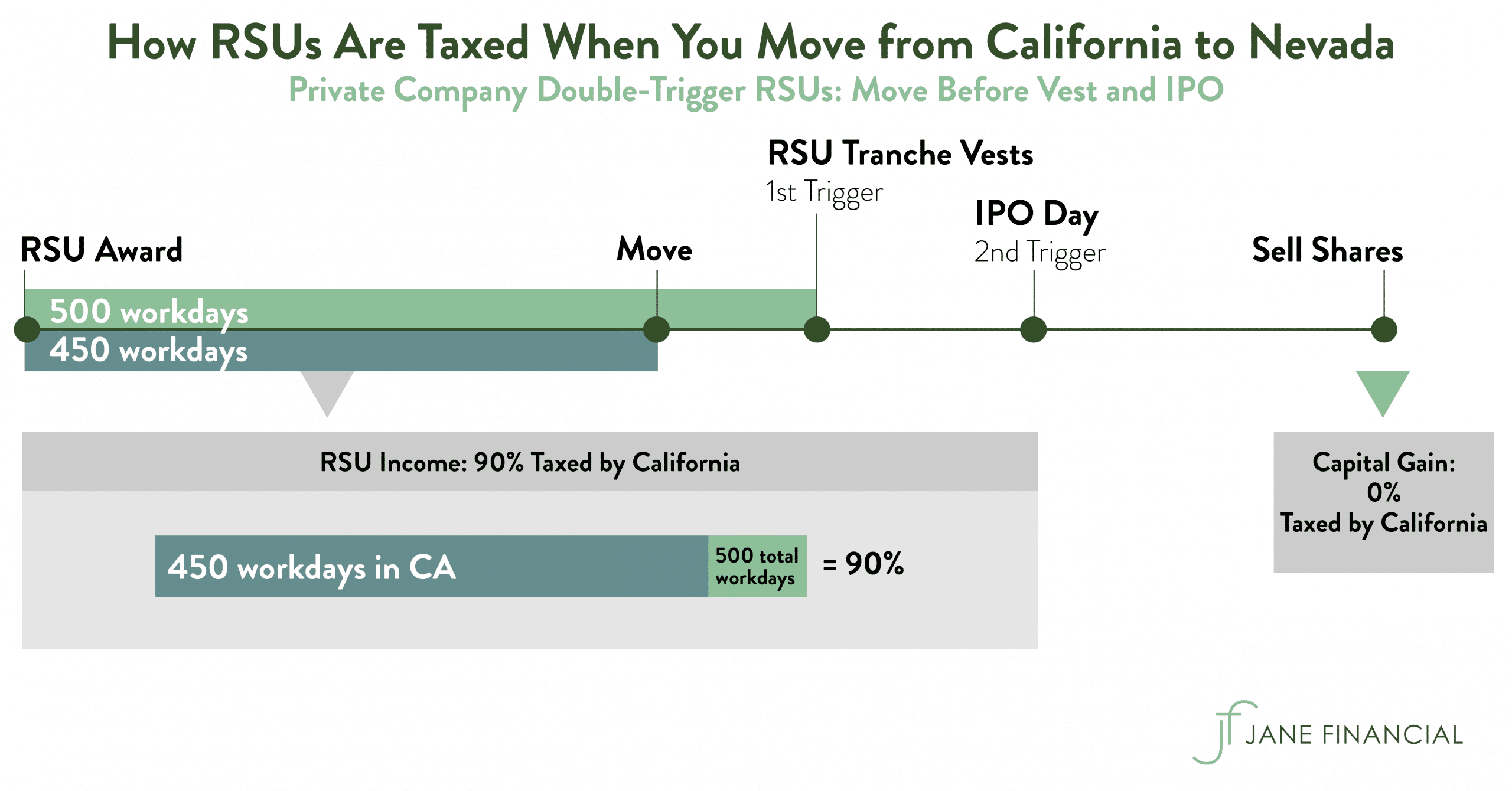

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Unit Rsus Strategy Guide Level Up Financial Planning

The Mystockoptions Blog Pre Ipo Companies

Tax Season 2022 What You Must Know About New Reporting Rules Mystockoptions Com

Restricted Stock Units Rsus Tax Calculator Level Up Financial Planning

Rsus Vs Options What S The Difference How To Switch Carta

Restricted Stock Unit Rsu Taxation Stay On Top Of Your Tax Withholding Lifesighted

Rsu Calculator By David Twizer

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Rsu Taxes Explained Tax Implications Of Restricted Stock Units Picnic Tax

Rsu Taxes Explained Tax Implications Of Restricted Stock Units Picnic Tax

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Rsu Taxes Explained 4 Tax Strategies For 2022